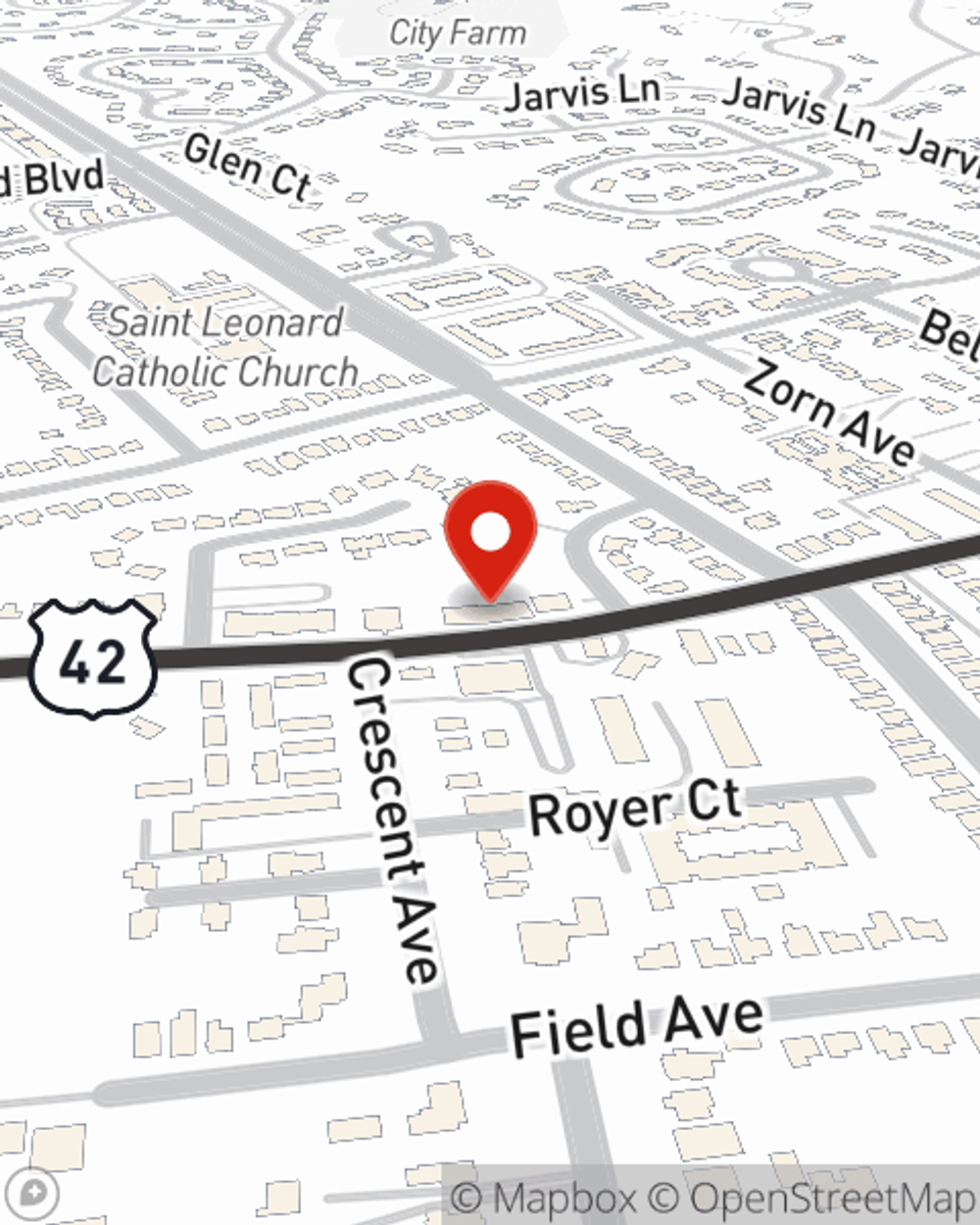

Business Insurance in and around Louisville

Louisville! Look no further for small business insurance.

Insure your business, intentionally

Business Insurance At A Great Price!

Being a business owner isn't easy. You want to make sure your business and everyone connected to it are covered in the event of some unexpected mishap or damage. And you also want to care for any staff and customers who become injured on your property.

Louisville! Look no further for small business insurance.

Insure your business, intentionally

Get Down To Business With State Farm

Protecting your business from these possible problems is as easy as choosing State Farm. With this small business insurance, agent Mike Shelton can not only help you design a policy that will fit your needs, but can also help you submit a claim should an accident like this arise.

Take the next step of preparation and reach out to State Farm agent Mike Shelton's team. They're happy to help you identify the options that may be right for you and your small business!

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Mike Shelton

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.